Bitcoin-backed loans offer a powerful way to unlock the value of your Bitcoin without the need to sell your holdings. By using your Bitcoin as collateral, you can access the US Dollars you need quickly and conveniently, all while keeping your assets safe and secure in Xapo Bank’s BTC Vault. If you're looking for fast liquidity, whether it’s to buy a house or fund a new business venture, Bitcoin-backed loans provide a smart and flexible solution.

Managing your loan should be simple and stress-free, which is why we’ve made the entire process easy and intuitive. Here’s a quick guide to effortlessly managing your Bitcoin-backed loan.

What is LTV?

Most important to consider is the Loan-to-Value ratio (LTV), which is influenced by the value of your Bitcoin and the amount of cash you borrow. As Bitcoin’s price fluctuates, so does the LTV. A rising Bitcoin value lowers the LTV, giving you more flexibility, while a drop in value increases the LTV, which may require additional collateral or could lead to the sale of your Bitcoin to repay the loan.

Keep an eye on your loan health

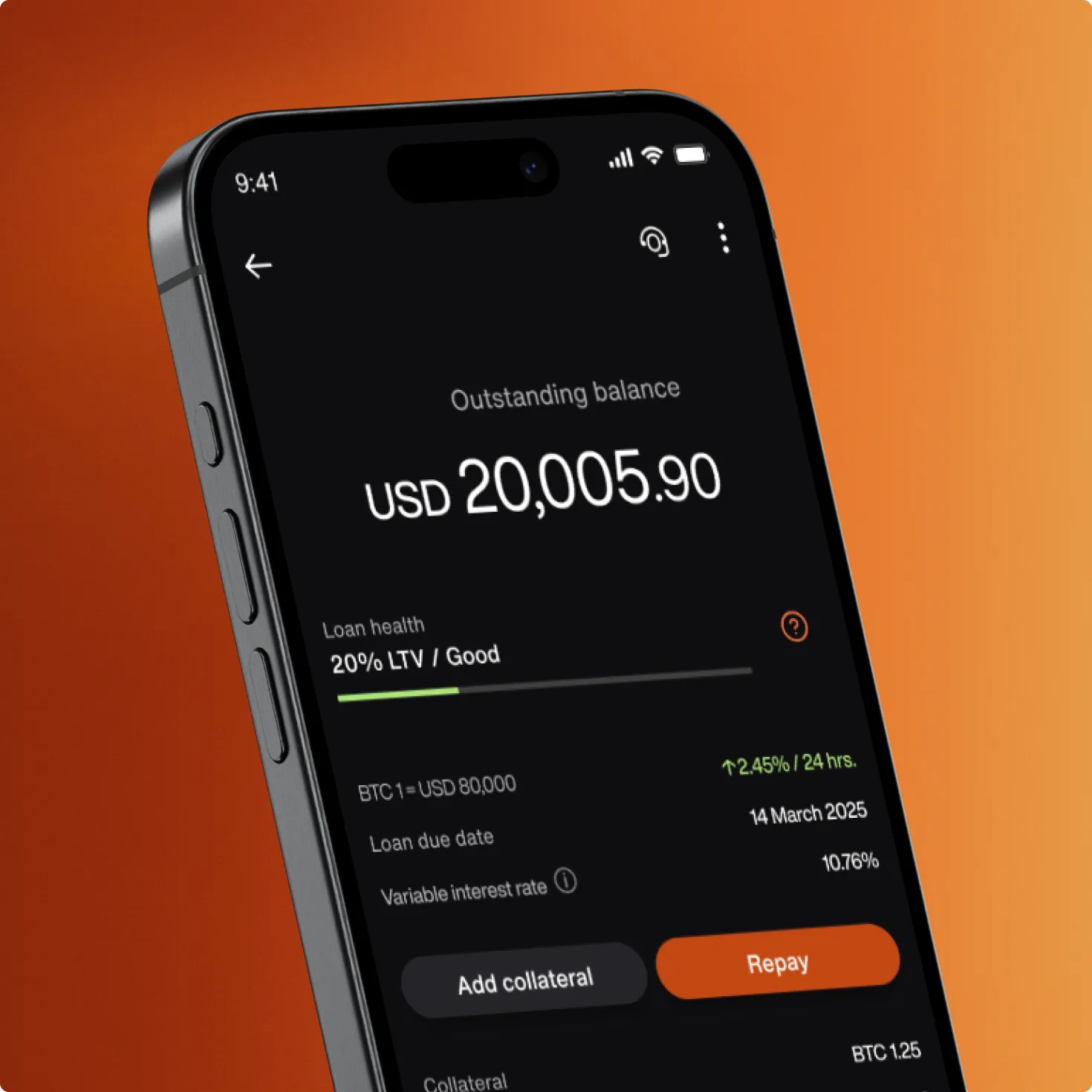

You can monitor your LTV at any time with real-time updates in our app. This allows you to check your outstanding balance, assess your loan’s health, and ensure your LTV ratio is kept in a good range. With constant access to this information, you can easily stay informed and manage your finances with ease.

Managing loan health and repayments

Monitoring your loan is key to staying on top of repayments and avoiding the need to sell your Bitcoin to repay the loan. This includes tracking your outstanding balance, the Bitcoin used as collateral, the interest due, and your repayment deadline.

By keeping your LTV below 50%, you stay within the safety margin and protect your collateral. If your LTV reaches 65%, a margin call will be triggered, requiring you to add more collateral or repay part of your loan. Should your LTV reach 80%, the applicable amount of Bitcoin collateral will be automatically sold to cover the outstanding balance, and the loan will be closed.

To bring your LTV back to a healthy range, you can either add more Bitcoin as collateral at any time through the app or repay part or all of your loan. The beauty of Bitcoin-backed loans with Xapo Bank is the flexibility—you choose the loan duration, set your repayment schedule, and decide the amounts that work best for you.

Download agreements and loan statements at your convenience

Easy access to your documents is essential, which is why we make it simple to download your statements instantly. Whether for personal records or financial planning, you’ll always have the information you need right at your fingertips.